It’s no longer simply about the bottom line. Today’s consumers care deeply about who they are buying from, not just what they’re buying. More over, organizations need to make a positive impact on the world around them, but it can be difficult to know where to start. In this 5-part blog series, we will discus how organizations can evaluate and improve their socioeconomic efforts using ESG.

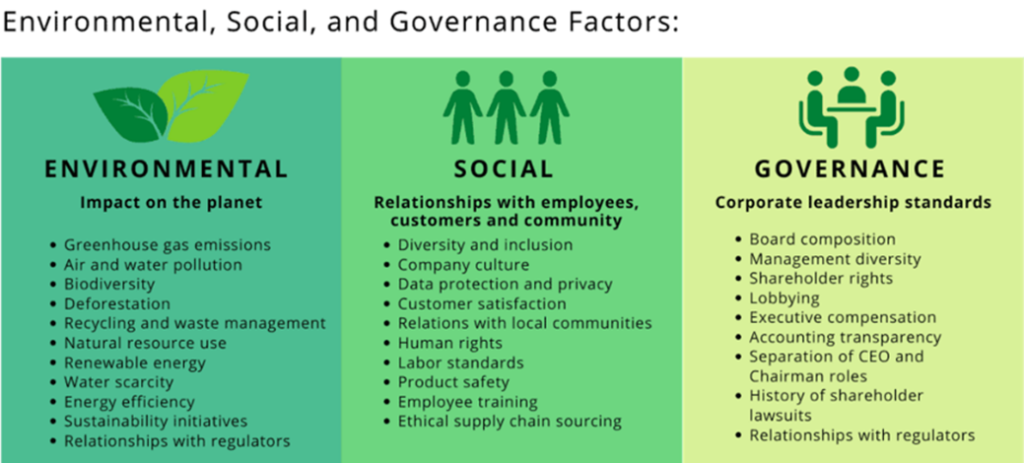

ESG stands for Environmental, Social, and Governance. These three factors consider the impact an organization has on itself, its customers and the community. In today’s climate, pun intended, adopting ESG measures is important for businesses of all sizes when considering future growth and profitability.

“The explosion of interest in ESG dates back to the 2015 Paris Agreement. The Agreement’s signatories pledged to limit the increase in global temperature to under 2 degrees Celsius above pre-industrial levels. With climate change increasingly in the mainstream, investors want to own fewer oil and gas stocks or to convince oil and gas companies to reduce emissions. Some are embracing ESG to reduce risk, because they think fossil fuels will underperform in a world moving toward renewables. Others take a moral view wanting their portfolios to reflect their values.”

(https://sustainfi.com/articles/esg-investing/)

“The E, or Environmental, in ESG measures a company’s impact on the planet, for example, through carbon emissions. Increasingly, businesses are setting emissions goals. Microsoft has pledged to be carbon-negative by 2030. Google plans to run all data centers on carbon-free power like wind or solar. Other environmental factors include pollution, energy efficiency, and sustainability initiatives like reducing plastic packaging.

The S stands for Social, referring to a company’s relationships with its employees, customers, suppliers, and local communities. ESG investors try to assess how well the company treats its workers and customers. Social issues received a lot of press coverage during the coronavirus pandemic. Amazon was criticized for running warehouses on a regular schedule at the height of COVID. However, it can be hard to quantify social elements like employee relations.

Finally, G, for Governance, measures corporate standards and shareholder rights. Unlike environmental and social metrics, governance has been on top of investors’ minds for a long time. Shareholders already vote on Board appointments and executive compensation each year.”

(https://sustainfi.com/articles/esg-investing/)

The top challenges of building, reporting, and sustaining a healthy ESG program are:

- Identifying data sources (internal, 3rd party/supplier, public)

- Shifting operations and culture where necessary

- Anticipating future standards and requirements

- Keeping abreast of stakeholder sentiment

- Getting your arms around third-party ESG risk

The system requirements and functionality differ for each pillar in E, S, or G. This blog series will explore the components and software systems in each pillar to uncover the data challenges organizations face as they begin focusing more on ESG programs.

Comments are closed